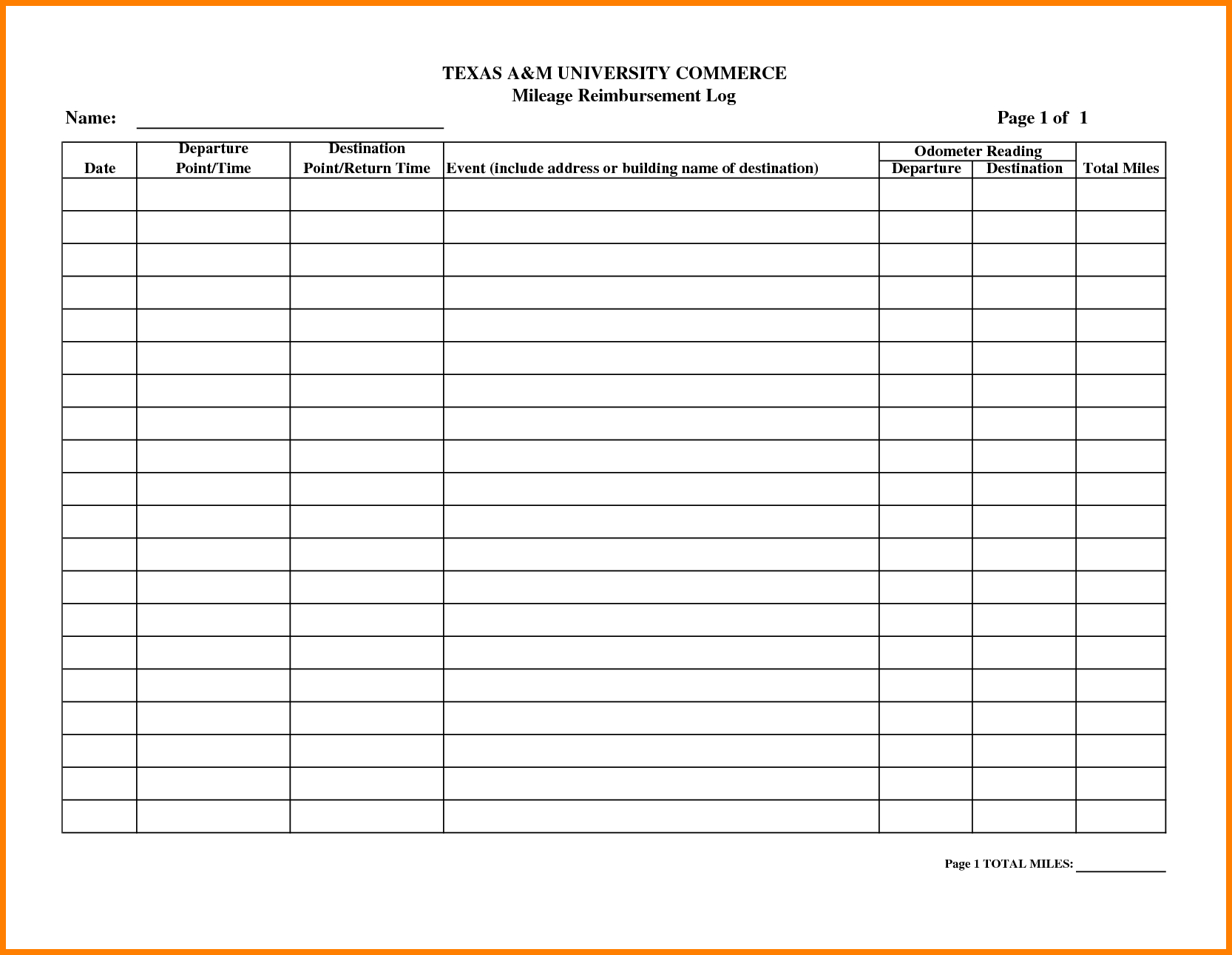

Irs Gas Mileage Reimbursement 2025. Use the standard mileage rate set by the irs (67 cents/mile for 2025) or customize a flat rate depending on the location, gas prices, and other expenses. Washington — the internal revenue service today issued.

These rates are issued by the internal revenue service (irs) to help drivers calculate costs for operating vehicles for business, charitable, medical, or moving. You can use this mileage reimbursement calculator to determine the deductible costs associated with running a vehicle for medical, charitable, business, or moving.

2025 Irs Mileage Rates Business Miles Livy Nicolle, Here’s how irs rules impact mileage rate and reimbursement for your employees and what it means for your taxes.

Irs Gas Mileage 2025 Calculator Marcy Sabrina, 17 rows find standard mileage rates to calculate the deduction for using your car for.

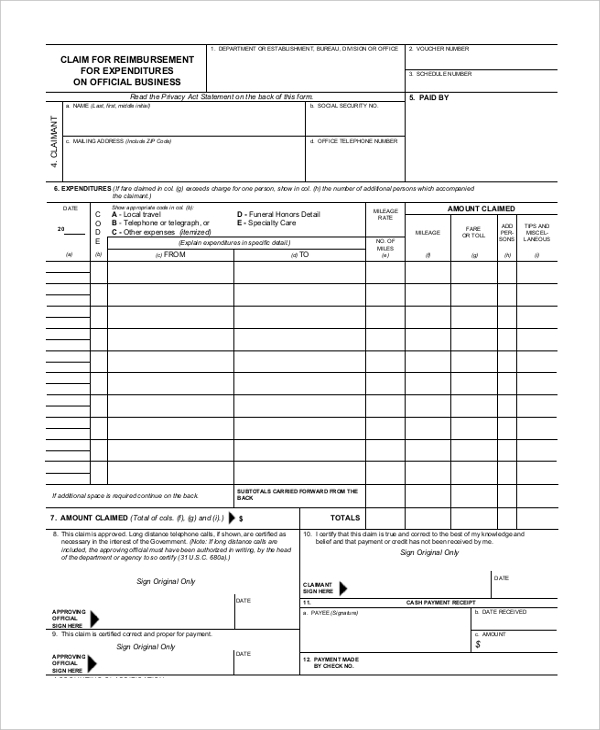

Irs Mileage Reimbursement Form 2025 Donica Rodina, Use the standard mileage rate set by the irs (67 cents/mile for 2025) or customize a flat rate depending on the location, gas prices, and other expenses.

Mileage Reimbursement 2025 Calculator Irs Yoshi Katheryn, The 2025 irs standard mileage rates are 67 cents per mile for every business mile driven, 14 cents per mile for charity and 21 cents per mile for moving or medical.

What Is The 2025 Irs Mileage Reimbursement Rate Connie Constance, 67 cents per mile for business purposes;

2025 Irs Mileage Rate Reimbursement Guidelines Shawn Dolorita, As to the federal mileage rate 2025, while certain factors, like gas and depreciation, appear to be falling, other costs, like the price of insurance new vehicles, are more than making up for that.