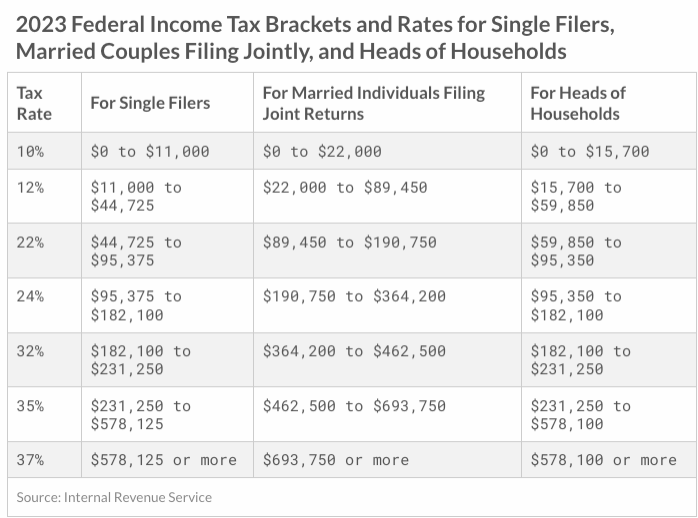

Irs Social Security Withholding 2025. Once you know how much of your. 2025 social security tax limit increase.

If your social security income is taxable depends on your income from other sources. The irs reminds taxpayers receiving social security benefits that they may have to pay federal income tax on a portion of those benefits.

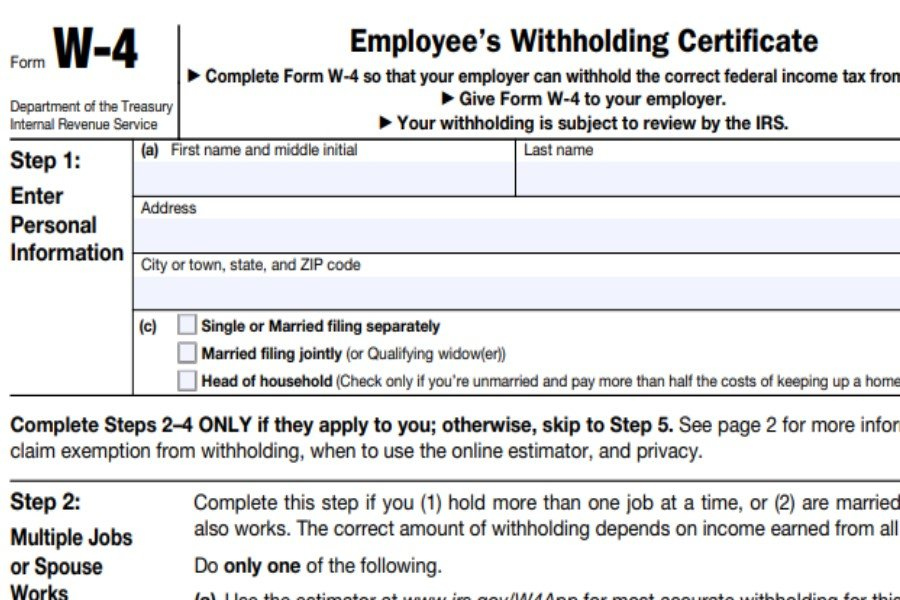

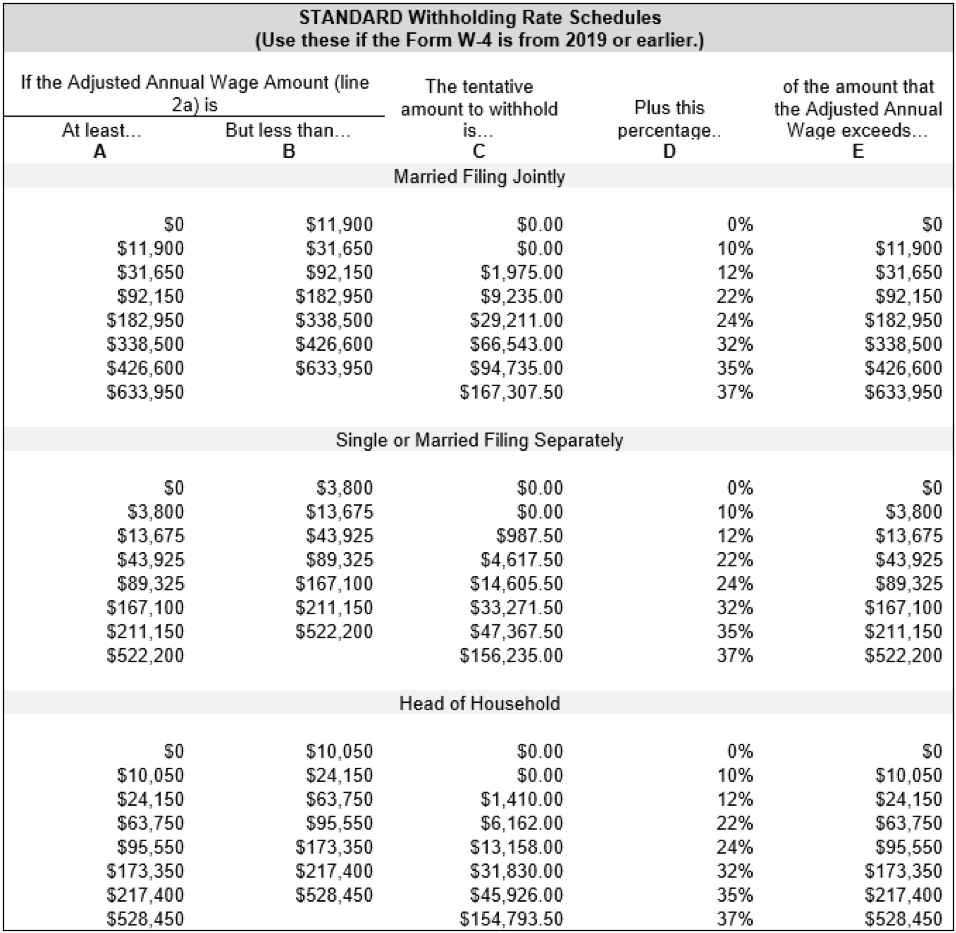

Social Security Withholding 2025 W4 Form Noami Winifred, Understanding how the social security tax impacts you as an individual taxpayer can be complicated.

2025 Max Social Security Tax By Year Chart Conny Diannne, The irs reminds taxpayers receiving social security benefits that they may have to pay federal income tax on a portion of those benefits.

Irs Social Security Withholding 2025 Donna Maureene, The irs reminds taxpayers receiving social security benefits that they may have to pay federal income tax on a portion of those benefits.

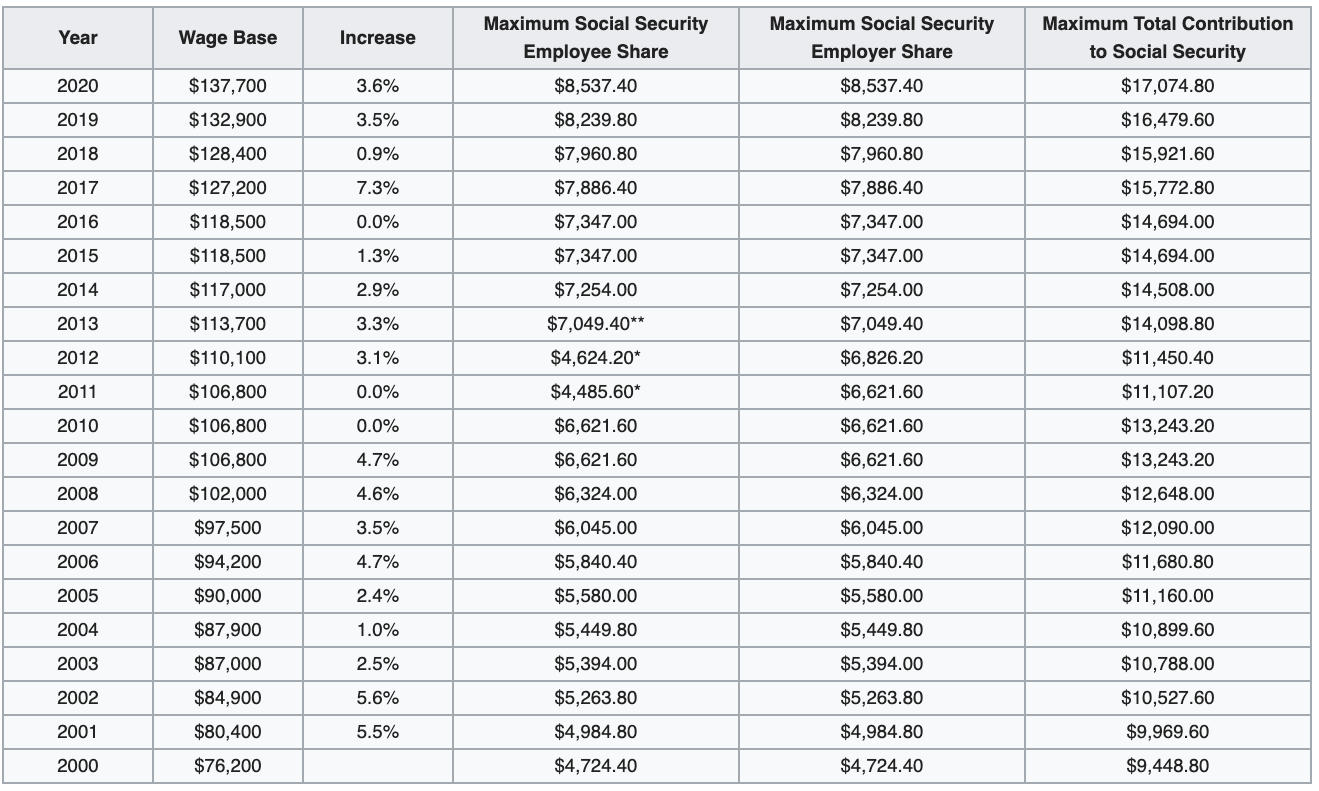

Social Security Limit 2025 Withholding Limit Vally Isahella, For 2025, the income cap for social security tax is $168,600, with the maximum tax withholding per employee set at $10,453.20, an increase from $9,932.40.

Social Security Tax Limit 2025 Withholding Tax Sonya Elianore, Social security and medicare tax for 2025.

Maximum Social Security Tax 2025 Withholding Table Amil Maddie, (for 2025, the tax limit was $160,200.

2025 Max Social Security Tax Withholding Table Dode Nadean, Social security and medicare tax for 2025.

2025 Social Security Maximum Withholding Edyth Haleigh, In 2025, the maximum amount of earnings on which you must pay social security tax is $168,600.